Steve Keen's Critique of Neoclassical Economics: Not Far Enough

How to dismiss neoclassical economics from an armchair

Steve Keen is a heterodox economist who criticizes neoclassical economics. He writes: “in terms of economic theory, my foundations are, in reverse chronological order, Minsky, Richard Goodwin, Schumpeter, Sraffa, Keynes, and Marx. I regard Minsky’s financial instability hypothesis as the crystallization of the alternative non-neoclassical thread that runs through all these authors.”1

Keen’s criticisms are situational and fail to grasp the larger reason why neoclassical economics is unscientific. He writes:

According to economic theory, each consumer attempts to get the highest level of satisfaction he can from his income, and he does this by picking the combination of commodities he can afford which gives him the greatest personal pleasure. The economic model of how each individual does this is intellectually watertight.

… Any two people get different levels of satisfaction from consuming, for example, an extra banana, so that a change in the distribution of income which effectively took a banana from one person and gave it to another could result in a different level of social well-being.

Economists were therefore unable to prove their assertion, unless they could somehow show that altering the distribution of income did not alter social welfare. They worked out that two conditions were necessary for this to be true: (a) that all people have to have the same tastes; (b) that each person’s tastes remain the same as his income changes, so that every additional dollar of income was spent exactly the same way as all previous dollars – for example, 20 cents per dollar on pizza, 10 cents per dollar on bananas, 40 cents per dollar on housing, etc. …

When conditions (a) and (b) are violated, as they must be in the real world, then several important concepts which are important to economists collapse. The key casualty here is the vision of demand for any product falling as its price rises. Economists can prove that ‘the demand curve slopes downward in price’ for a single individual and a single commodity. But in a society consisting of many different individuals with many different commodities, the ‘market demand curve’ can have any shape at all – so that sometimes demand will rise as a commodity’s price rises, contradicting the ‘Law of Demand.’

… [This] chapter’s punchline is that economic theory cannot derive a coherent analysis of market demand from its watertight but ponderous analysis of individual behavior. In addenda, I show that this analysis is only a toy model anyway – it can’t apply to actual human behavior, and experimentally, it has been a failure.

Can you sniff out Keen’s buy-in to the fundamental epistemic validity of neoclassical models? His criticism revolves around premises failing to hold in real life, leading to the failure of empirical studies to validate neoclassical models.

Guess how neoclassical types, whose careers consist of pumping out neoclassical models, who thus can’t stand to lose the acceptance of these models due to their pseudoscientific nature, react to this? They make new models! They can always do this, because there are infinitely many neoclassical models, since neoclassicists have no respect for verification or elegance. No matter how unverified, no matter how convoluted, the neoclassicist will always be rewarded for adding an epicycle.

We are now getting at the deeper issue with neoclassical economics: its disrespect for verification and parsimony.

Parsimony through verification

Real scientific models are composed of estimatable parameters. And example of a real scientific model is the breeder’s equation:

This model has 5 parameters. Every parameter is observable. It’s used in the breeding industry, where the relation is used to predict an unobserved parameter from knowledge of the others.

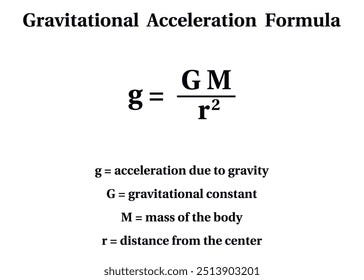

Another example is any equation from Newtonian mechanics.

This model has 4 parameters. They are all observable.

Because these models are verifiable, they are parsimonious. If you seek verifiability, you will find parsimony. Why have an extraneous variable? It’s more bothersome — since you have to measure every variable, you only use what you need.

Neoclassical models: not verifiable

A utility function isn’t observable.

If it were observable, they would know what it is.

If I used a breeding function instead of giving a specific function, is my model verifiable?

“In order to express our concept of evolution in terms of functional theory, it is first assumed that a population’s evolution can be represented by the breeding function B(x_1, … , x_n), where x_i denote the quantities of distrinct selection pressure the population experience during a given period of time during which it reproduces …”

Is this scientific, or is this disappointingly vague?

Not only is it not verifiable, we don’t even know how many parameters we have, because we only have a pseudomodel.

Neoclassical models are pseudomodels.

See for yourself:

Less abstractly, we can use the following intuition: is utility observable? Clearly not, because we can’t see your mind state. But not so fast! Let’s define it as wantability, the order in which alternatives are chosen as we ban chosen options and repeat the choosing. But this will never recover a general utility function for a given individual. This is why there are never any studies find the form of a person’s utility function and use it to predict their behavior. Meanwhile, studies like that do exist for IQ, gene scores, and so on.

You can be quite certain when utility function is written, it’s all armchair and no data. A neoclassical economist would never in a million years stoop so low as to measure a utility function.

We conclude it can’t be done, or at least that it’s unfeasible. It’s a dead end. It’s time to retire the concept of “utility function” — any model with on is basically guaranteed to be unverifiable.

The same can be said for the theory of the firm. A similar critique can be written of the neoclassical concepts of firm, profit, revenue, cost, and money. These concepts are too vague to be assigned to variables and differentiated. I leave most of this argument as an exercise for my oh-so intelligent reader, but I will drop some hints first. The first three concepts depend on the last concept, money. But what do economists know about money? Money is literally sociobiological illuminati voodoo, and economists have a bartering myth about it and nothing else. It’s a piece of paper usually with some guy’s face on it, the color differs depending on which person will murder you for printing it yourself — but that guy is allowed to print any amount of it he wants and that’s called “monetary policy” or something. You’re supposed to slave away your whole life for it — for who exactly ? — so you can acquire it, since the other feces emitting monkeys will trade almost anything for it. Why? Unless you’re born with a lot of it or win a lot of it randomly in which case everyone else is your freelance slave! And they can’t audit you and rip it all away from you as an inferior, lucky master — the murderers from before will protect you as long as you didn’t commit a couple fraud laws to get it.

What the fuck? The first thing I expect is for that to be explained thoroughly in economics. Instead they dodge the question and any old textbook on the topic opens with utility nonsnese before moving onto profit optimization. Maybe in the introduction they quote the infamous bartering myth.

At the individual level we have bio-psychological money psychology, which sociobiology can tackle. At the level of economics a good starting point is monetary econophysics.

Here we see a verifiable and parsimonious model relating some population parameters to the distribution of money.

We go from “you’re doing calculus at the store when you shop to maximize U(.) relative to your wallet”, with me thinking “no I don’t, I don’t even look at prices, I just follow raw instinct and the price comes out to something affordable inevitably, often I will go years before discovering a new thing I like randomly because I don’t even search the store much less to I perform a Langrangian optimization on prices”, and “firms, which exist in a purely competitive marketplace, optimize profits” with me thinking “then why isn’t there mass unemployment? why are ‘firms’ woke? What is a firm? what is a profit? what is a dollar even?” to “when people trade entropy will in part lead to large wealth differences due to accumulated differences in luck. Our simulated distribution is very close to the empirical one by the way and we have 2 parameters in our explicit model, which we can estimate.” Huge improvement, clearly!

It goes from completely uninsightful, dogmatic nonsense to potentially revealing a fundamental truth about why Elon Musk is worshipped and you’re poor: he got lucky 3 times and you got unlucky 3 times. Oops!

Macroeconomics

Keen avoids producing unverifiable slop because he appears to do macroeconomics, where neoclassical is microeconomics, which is in turn essentially economists’ little in-house psychology theory upon which they attempt to derive some structure for macroeconomics. Macroeconomics itself however is focused on relating observables like unemployment, GDP, inflation rate, interest rates, etc.

Structure for macroeconomics is important, because without it, macroeconomics may be verifiable and parsimonious, but it is extremely hard to actually test, because it concerns societies which move much more slowly than individuals’ lives. Theoretical structure therefore would help macroeconomists have a firm foundation upon which to model. They have never truly had this, and so have been hobbled thus far, but econophysics and sociobiology may offer it in the future.

Macroeconomic Theory and Its Failings, p.128

Youre telling me you don't have a notebook where you find optimal ratios of oranges and bananas while grocery shopping?

The only thing I would maybe add into the mix of Sociobiology and econophysics is a biophysical view which incorporates the factor of energy through for example looking at the eroi of different energy sources which in turn dictate to a certain extent the scope of economic activity (in combination with genetic factors ofc). So one dollar, a made-up monkey token, gives you access to x Joule of the society wide energy flows in order for you to temporarily defeat entropy